Home Loan Give Back Campaign

Making Michigan Feel Like Home

We help our members purchase and improve their homes through our home loan program, but we wanted to find another way to give back to the people who live in our state.

“Lake Trust is amazing! Thank you so much for all of your support to our mission. We are humbled by your generosity and consider you a valued partner in coming together with us to end homelessness.”

-Kari Nies, Humble Design Development Manager

Operating as a social purpose company means finding new ways to help our members and our communities. So, in July 2019, we kicked off a unique home loan campaign. Members who closed a home loan with us received $100 or $250 from us to help with expenses and we donated another $100 or $250 (depending on the loan type) to one of six nonprofits in Michigan with a focus on housing.

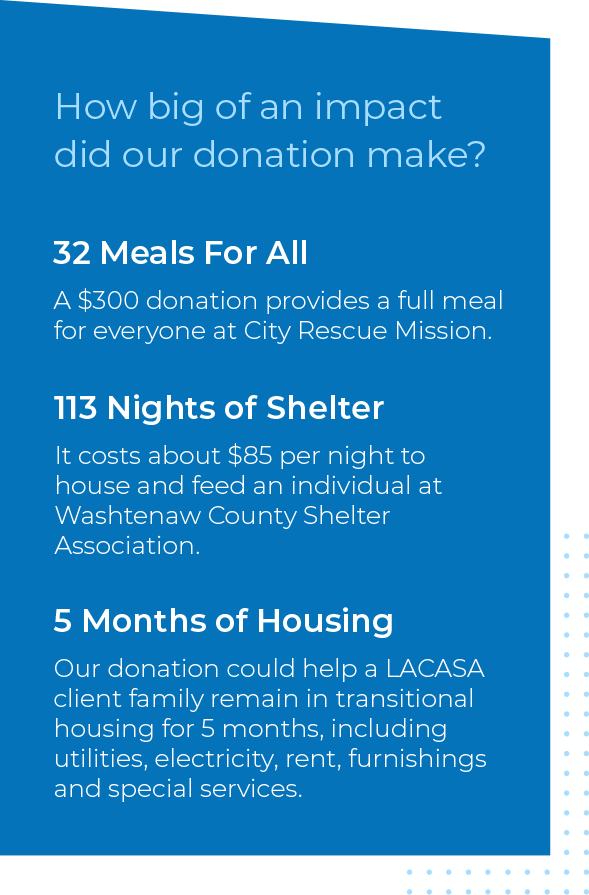

By choosing us for their home loan needs, our members helped us accumulate a total donation of $57,850 to support Michigan nonprofits. In February 2020, we surprised Isabella County Restoration House in Mt. Pleasant, City Rescue Mission in Lansing, Love in Action in Grand Haven, Humble Design of Pontiac, Washtenaw County Shelter Association in Ann Arbor and LACASA in Howell with a $9,642 donation each. Together, we supported those in need and helped Michigan feel a little more like home for everyone.

View more photos on Facebook1